adjective.Accrual basis accounting applies the matching principle – matching revenue with expenses in the time period in which the revenue was earned and the expenses actually occurred. accumulate, collect, gather, build up, mount up, amass, grow, increase, augment, be added. If a business records its transactions under the cash basis of accounting, then it does not use accruals.

Think of accrued entries as the opposite of unearned entries the corresponding financial event has already taken place but payment has not yet been made or received. Interest in a savings account, for example, accrues so that over time, the total amount in that account grows.An accrual is an accounting adjustment used to track and record revenues that have been earned but not received, or expenses that have been incurred but not paid. “Accrue” is a term used to describe the ability of something to accumulate over time, and is most commonly used when referring to the interest, income, or expenses of an individual or business. They can be used to match revenues, expenses, and prepaid items to the current accounting period-but cannot be made for reversing depreciation or debt. Despite this, reversing accruals are optional or can be used at any time since they don’t make a difference to the financial statement. By reversing accruals, it means that if there is an accrual error, you don’t have to make adjusting entries because the original entry is canceled when the next accounting period starts. The Difference Between Accrued Expenses and Accounts PayableĪccruals will continue to build up until a corresponding entry is made, which then balances out the amount. Accruals are expenses or revenues incurred in a period for which no invoice was sent or no money changed hands. However in the Accrual Method the revenue will be recognized in the same period, an “Accounts Receivable” will be created to track future credit payments from the customer.

The revenue generated by the sale of the merchandise will only be recognized by the cash method when the money is received by the company which might happen next month or next year. That way, recording income can be put off until the next tax year, while expenses are counted right away.

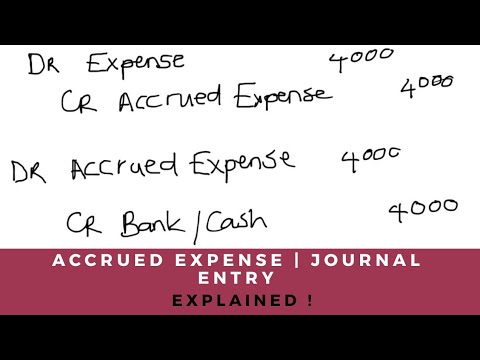

Definition of accrued expenses how to#

How to Accrue an Expense: 6 StepsFrom a tax standpoint, it is sometimes advantageous for a new business to use the cash method of accounting.

0 kommentar(er)

0 kommentar(er)